Your Trusted Ontario Mortgage Agent

Your licensed mortgage agent in Ontario, Canada, with years of experience in helping individuals and families secure their dream homes.

I'm here to guide you through the mortgage process and find the perfect solution for your unique needs.

Your Dream Home, Our Mortgage Expertise

Personalized Mortgage Solutions

We offer tailored mortgages for various needs, like first-time buyers or investors.

Expert Guidance

With 25+ years in Ontario's mortgage market, we provide expert guidance based on trends, rates, and demographics.

Comprehensive Market Knowledge

Leverage our Ontario mortgage expertise with historical rate data and central bank insights for informed decisions.

Streamlined Process

Streamlining mortgages for a stress-free experience, we save you time.

Access to Exclusive Rates

Access exclusive rates through our lender network, saving thousands long-term.

Ongoing Support

Our support extends beyond closing, assisting with your mortgage needs throughout.

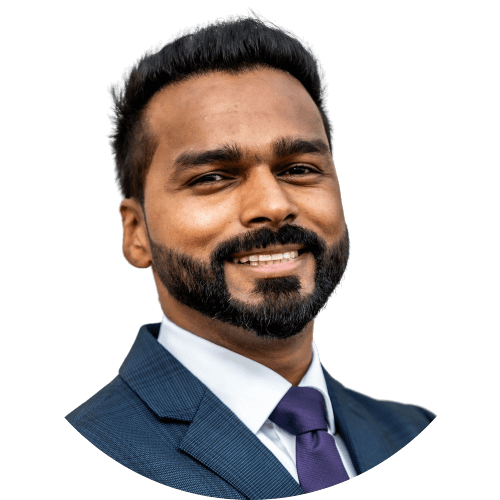

About Me

Welcome, I'm Sherrick Pitchen, your trusted Mortgage Agent. With a proven track record and years of experience, I bring a wealth of expertise to the realm of mortgage solutions.

My mission is simple: to ensure that every client finds the perfect mortgage solution that aligns seamlessly with their unique financial goals and aspirations.

Credentials: As a licensed Mortgage Agent in Ontario, I possess the knowledge and qualifications necessary to navigate the intricate world of mortgages. I remain up-to-date with the latest industry regulations and market trends to provide clients with the most current insights.

Let's work together to transform your homeownership goals into reality. Contact me today, and let's embark on this exciting journey.

Client Benefits

Savings

Our expertise secures the best rates, saving you money long-term.

Confidence

Gain confidence in your mortgage decisions with our guidance and insights.

Time Efficiency

We simplify mortgages, saving you time and effort in complex processes.

Personalization

We tailor mortgages to match your unique financial goals and lifestyle.

Peace of Mind

Rely on our experience and market knowledge for a reassuring mortgage journey.

Long-Term Support

Our commitment goes beyond the transaction, providing ongoing support for a stress-free homeownership journey.

I had a seamless and stress-free experience with Pitchen Mortgages. Their knowledge of the Canadian mortgage market and their dedication to their clients made the process smooth and efficient. Thanks to their support, I'm now happily settled in my new Canadian home.

John

When it comes to mortgages in Canada, Pitchen Mortgages is the name you can trust. Their team's professionalism and commitment to customer satisfaction are unparalleled. They helped me find the ideal mortgage solution, and I couldn't be happier with the results.

Robert

Ready to take the first step toward your dream home? Book a video call with me now!

Frequently Asked Questions

Got questions? We have got answers

How do you prepare for a mortgage renewal?

By doing your due diligence and choosing not to settle for whatever your current lender presents to you. When your mortgage is up for renewal, it’s a time for you to re-evaluate your financial situation and revisit all the elements of your existing mortgage from the interest rateright through to the loan amount and amortization.

How do you create an emergency fund by tapping into your home's equity?

You can secure a Home Equity Line of Credit (HELOC) against your property, which is a flexible loan that you can draw from when you need funds, and pay back as you please without penalty. Some homeowners obtain a HELOC strictly as an “emergency fund” for peace of mind, in the event they need it.

How do you obtain a $4000 land transfer tax rebate?

If you’re a first time homebuyer and you qualify for the land transfer tax rebate, you can receive a maximum rebate of $4000 (which is the full amount of land transfer tax up to a maximum purchase price of $368,333). Simply apply within 18 months of your property purchase, and the government will send your rebate either via cheque or direct deposit into your bank account.

What are the costs associated with refinancing my mortgage?

If your mortgage is not yet up for renewal and you want to refinance, your closing costs will include a mortgage prepayment penalty (amount depends on the type of mortgage you have), mortgage discharge fee (when you switch lenders), mortgage registration fee (to register the new mortgage), and legal fees (to review the mortgage loan and conduct a title search).

What are good reasons to pull equity out of my property?

Obtaining a mortgage that gives you extra cash out of your home can be intelligently used to pay off high-interest debts, fund a home renovation, put a down payment on a vacation or investment property, pay for extended healthcare or invest in your child’s education.

How do I qualify for a mortgage?

Among other things, lenders in Canada primarily look at three major qualifying criteria: your credit score (showing how well you manage your credit and loans), your debt-to-income service ratio (percentage that tells lenders how much of your income goes towards regular, recurring expenses), and your home equity (the difference between the appraised market value of your property and your loan amount).

When should I strongly consider a refinance?

If you’re locked into a mortgage rate that is above current market interest rates. If you have a variable rate and you want to reduce your risk by acquiring a fixed rate mortgage. Your property has equity and you need the cash. You are interested in lowering your regular monthly payments to improve cash flow.

When should I NOT consider a refinance?

If you’ve had your mortgage for a long time, because this means you’re finally starting to pay off more principal than interest. If your current mortgage has a prepayment penalty that doesn’t make sense financially. If you are planning to move in the next few years, since this will force you to incur penalties at the time of your relocation.

What type of refinance is right for me?

This is what you have a mortgage broker for. Once we have a good idea of your current financial situation, we can advise you of the best type of loan for your refinance in order to achieve your goals.

How do I get a pre-approval?

Contact 8Twelve and we’ll walk you through our fast and straightforward pre-approval process.

The Future of Homebuying: Secure Your Video Call Appointment Now

Experience the future of homebuying with our video call appointments. Secure your appointment now for a convenient and modern way to start your homeownership journey.

© 2023. All Rights Reserved | Design by Digital Mak Media